Thammasat University students interested in ASEAN studies, political science, history, diplomacy, international relations, American studies, and related subjects may find it useful to participate in a free 8 November Zoom webinar on What Does the US Election Mean for Southeast Asia?

The event, on Friday, 8 November 2024 at 9am Bangkok time, is presented by ISEAS – Yusof Ishak Institute, Singapore.

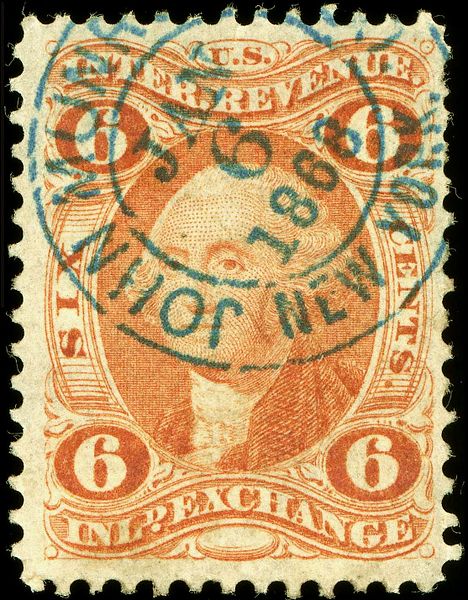

The TU Library collection includes some books about different aspects of American electoral politics.

Students are welcome to register for the event at this link:

https://us06web.zoom.us/webinar/register/7017289810871/WN_PyFTWigVTQS3v9ml4wq2gg#/registration

The event website explains:

The US Presidential election, pitting Vice President Kamala Harris against former President Donald Trump, appears headed for a razor-thin finish. While Trump has been forthright in articulating his intention to pursue protectionist policies, including 10-20% universal tariffs across the board and tariffs of at least 60% on China, Harris has been more circumspect, criticizing the Trump tariffs as a tax on US households while also expressing her support for strategic and targeted tariffs to support US workers.

What are the implications of either a Harris or Trump presidency on trade with Southeast Asia? Would a Trump presidency inevitably mean rockier trade relations for the region, and are any countries especially vulnerable? Would a Harris presidency essentially be a continuation of the Biden trade policies, or are there changes the region needs to be prepared for? Under either candidate, would the Indo-Pacific Economic Framework (IPEF) Agreement be brought to a successful conclusion, or would it be discarded? How are US-China trade relations likely to be handled, and what is the likely impact on Southeast Asia?

About the Speaker

Stephen Olson is Visiting Fellow at the ISEAS – Yusof Ishak Institute. […]

A posting from August 2024 on the website of the Lowy Institute explains:

Southeast Asia has low expectations of America, including Trump

For a region already sceptical of US reliability and commitment, Trump’s return to power would be worrying, but not gravely alarming.

Key Judgement

Southeast Asian countries have less to lose from a second Trump administration than much of the world. Southeast Asia will not be a focus for a re-elected President Trump, which may allow other parts of the US system, including Congress, State Department, and US Indo-Pacific Command, to drive US engagement. On the issue of rebalancing alliances — a focus for Trump — no Southeast Asian country is likely to be in the frame.

The region sees itself as less dependent on the United States than, for example, Europe, Japan, South Korea, or Australia. A common view within elite circles, especially in mainland Southeast Asia, is that the United States is a distant power, whose engagement has waxed and waned since the end of the Cold War. Especially in the region’s Muslim-majority countries, Washington is not necessarily seen as a benign actor that abides by international rules.

In authoritarian countries, by contrast, Trump’s possible return to the White House may be seen as a positive. Myanmar’s generals and Cambodia’s autocratic elite would likely welcome the prospect of a US president less focused on democracy and human rights. The Biden administration’s global democracy promotion agenda always sat uncomfortably in a region as politically diverse as Southeast Asia. Even in the region’s largest democracies, Indonesia and the Philippines, “strongman” leaders have political appeal and cut-through.

US neglect is fine, but China escalation is not

The main regional concern of a second Trump presidency would be the risk of a more confrontational China policy. Southeast Asian countries worry about US–China competition escalating into conflict. Moving away from the “managed competition” with the guardrails of the Biden administration would not be welcomed by Southeast Asian capitals. Many have been reassured by the Biden administration’s efforts to build up direct communications with Beijing; repudiating these would be seen by many as provocative and stoking tensions.

Under the first Trump administration, “tough on China” policies saw a proliferation of regional initiatives, many of which lacked nuance.

A “tough on China” policy might also see the United States push Southeast Asian countries to make choices in a counterproductive way. Under the first Trump administration, “tough on China” policies saw a proliferation of regional initiatives, many of which lacked nuance. These included trying to convince Southeast Asian countries to ban Huawei from 5G networks, without offering an alternative, and funding a social media disinformation campaign to discredit Chinese Covid-19 vaccines in the Philippines.

Philippines the outlier

The Philippines is a possible outlier to this picture. Unlike the rest of Southeast Asia, which will continue to avoid aligning with either Beijing or Washington, Manila under President Ferdinand Marcos Jr has doubled down on its alliance with the United States. It faces a tough challenge from China within its Exclusive Economic Zone, especially at the Second Thomas Shoal. The credible commitment of the United States to defend its treaty ally is an essential component of Manila’s strategy.

However, the Philippines also wants to retain room for independent manoeuvre, for example, by re-establishing diplomatic dialogue with Beijing. If a second Trump administration wanted to play a more active role in the South China Sea, Manila might find that it was informed, rather than asked, about a stepped-up US military presence. This is better than a scenario in which the United States failed to back the Philippines, but could still cause problems for Manila.

Vietnam has much to lose in a trade war

On economics and trade — Southeast Asia’s highest priority — the region will have low expectations. Few will grieve the Biden administration’s Indo-Pacific Economic Framework (IPEF), which Trump has vowed to “kill”. While some in Southeast Asia saw IPEF as a useful way of keeping America talking on trade, it never offered improved access to the US market for Southeast Asian exports. Even more modest goals of a digital trade agreement were scuppered in 2023.

Pragmatism means most in Southeast Asia are calm about the idea of Trump returning.

The best-case scenario for US economic engagement under Trump would be a maintenance of the status quo in which the US private sector is active, but with little by way of supporting economic statecraft. Increased protectionism or across-the-board tariffs would harm trade-exposed Southeast Asian countries. It is possible that Vietnam could be specially targeted for higher tariffs — its trade surplus with the United States has grown steadily and is now the fourth-largest in the world. Hanoi’s reputation as a key beneficiary from the relocation of supply chains from China prompted by the first US–China trade war will not endear it to a second Trump administration.

Pragmatism means most in Southeast Asia are calm about the idea of Trump returning. However, they, like the rest of the world, will need to reckon with the prospect of a diminished, more unpredictable America providing less leadership and stability than before.

(All images courtesy of Wikimedia Commons)